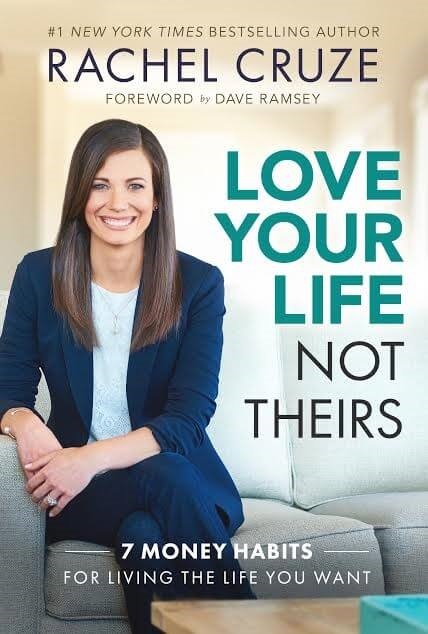

Finance skilled Rachel Cruze shares her trip spending advice for households.

{Photograph} credit score rating: Cameron Powell

It’s in all probability essentially the most nice time of 12 months — as these festive lyrics state — with recollections to cherish with out finish. The holidays are merely throughout the nook, which means satisfying, meals, family…and funds. As regards to trip spending, it might even be a downright worrying time of 12 months.

Financial skilled and mother Rachel Cruze author of Keep Your Life Not Theirs, understands how, and why, mom and father actually really feel financially burdened spherical Christmas. The Ramsey Choices group member shares some wise advice on how households can steer clear of overspending.

“Within the occasion you try to financially ‘Maintain with the Joneses’ your full life, you’re going to end up broke,” says Cruze. “The comparability sport you’ll not at all win. It you might be apprehensive about what others are giving, it could steal the enjoyment out of your trip season, and as well as your paycheck.”

Consistent with Cruze, daughter of budgeting guru Dave Ramsey, one of many easiest methods to start out saving money inside the new 12 months is to take a look at your entire payments this month — December — and your entire needs. “Research each little factor it is essential to spend money on, not along with the holidays, and guarantee after all that is coated. If there could also be any money left, say, ‘That’s the portion we have to spend on gadgets.’ Let your financial state of affairs dictate your funds, not what everyone’s wants are.”

Use Internet pages like Pinterest to look out ideas for affordable hostess gadgets. “There are numerous little, straightforward trinkets available on the market that make good gadgets. You presumably can spend $15 on a candle and Williams-Sonoma spatula, and there’s your current to anyone that they are going to, and may, really use.”

Cruze advises mom and father to solely be honest with kids about trip spending if situations are highly effective. “Talking alongside together with your kids is important. Set expectations and say, ‘Hey, our Christmas continues to be going to be satisfying this 12 months, you might be nonetheless going to get a gift or two,’ nevertheless make clear why you wouldn’t have the money to do X, Y, Z and that’s what’s best for the family — notably within the occasion that they are of the age of understanding.”

“Take note,” says Cruze, “you’ll get ten gadgets on the buck retailer, youthful kids most probably is not going to know the excellence, and no, you aren’t a nasty guardian for doing that. Flip off your cell telephones, and easily spend time alongside together with your kids. That’s what they are going to remember.”

Now, in case your child has a late December birthday, current giving can get troublesome throughout the vacations. “Your funds goes to be the equivalent. If a birthday takes away just a bit money from Christmas, so be it, since you do not want to take a birthday away from a toddler just because they’d been born in December. Your Christmas and birthday funds are going to solely be one.” To make December infants actually really feel explicit, she recommends wrapping some presents in ‘Fully happy Birthday’ paper and others in trip paper.

Right here is her advice for youngsters who have to earn money: Create a chore chart, and pay your kids weekly on the chores they full, because of in doing so, there are so many teachable moments. Label three envelopes: Giving, Saving, and Spending

“As quickly as kids put their money in each of those envelopes, you might be educating them straightforward strategies to be intentional with the place their money’s going and that’s what budgeting is,” says Cruze. “After they’re doing this with money they earned themselves, they really give, save, and spend in any other case.” In her non-public weblog, she recollects what her mom and father taught her and her siblings about incomes: “You are employed, you receives a fee. You don’t work, you don’t receives a commission. Like within the precise world.”

Saving moreover delays on the spot gratification. “The debt commerce loves on the spot gratification: ‘You presumably can have one thing you want, you merely should enter debt for it.’ Successfully, saving delays that. It displays persistence and character-building options, which is one factor I found as a baby. There’s quite a bit information and life lessons in saving. Children will actually really feel that possession delight and look after points larger as soon as they saved up for it. Saving teaches kids accountability, which they carry into maturity.”

Cruze recommends her dad’s e ebook sequence Junior’s Adventures, which explains to kids the value of money. “I would like to coach my kids to be other-centered, versus self-centered, and it may begin with money,” says Cruze, who has a youthful daughter. “I do think about selfless people prosper and have larger prime quality relationships and a higher prime quality of life.”

Furthermore, she advises households on New Yr’s Day, no matter the place you are financially, “to do a funds, on paper, your laptop computer, or your cellphone. It’s a must to see the numbers visually. Your goal is to take your earnings for January, minus your entire payments, and have it equal zero.” So, every buck that’s coming in in January is designated to a category.

Now, inside that funds, put “Giving” on the prime, “Saving” second, after which “Payments,” equal to your funds and meals, rent, mortgage. That’s the plan you reside by. “It must be highly effective, notably if that’s your first time doing a written funds like this. It may take you about three months to get the dangle of it.” Discover that it’s going to not be wonderful in January, nevertheless really try to observe that zero-based funds. Adhere to this in January, and February will be easier, March will be easier, “and sooner than you acknowledge it, a habits will be part of your life,” says Cruze.

Whole, Cruze wants households to fluctuate their views on budgeting. “It doesn’t limit your freedom, it gives you permission to spend money. Rethink the way in which wherein you check out your funds; it gives you freedom to spend with out guilt or questioning.”

{Photograph} credit score rating: Cameron Powell